Surety Bonds

What is a Surety Bond?

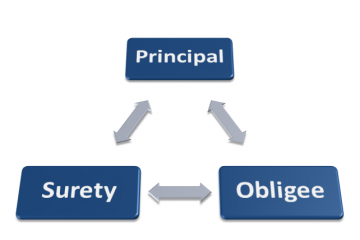

A Bond is a guarantee between three parties. The three parties to a surety bond are:

The principal - is the one who is being required to obtain the bond.

The Obligee – is the one requesting the bond for financial security.

The Surety Company - guarantees the obligee that they will pay if there is a claim.

How the bond works: The Principal and the Surety company stand “jointly and severally” (both 100% responsible) to meet the obligation of the bond. The Principal and Surety are obligated to the Obligee. It is the Obligee, and most cases the general public who is protected and has the ability to claim on the bond. It’s the Principal responsibility to pay all obligations that arise from their operations. If the Principal defaults on a claim, the Surety is obligated to pay on their behalf. They surety will then enforce the indemnity agreement to recoup their loss from the Principal.

Have more questions? Call 925-516-4700 or contact us.

Get a Free Quote

It's quick and easy,and your information is secure.

Contact Us

Prefer to talk to a person? Call us anytime!